Check Your CIBIL Score Before Applying For A Car Loan To Buy These Upcoming Vehicles

So often when a new car makes an entry into a market, the crazy onlookers get their eyes firmly attached to it. The wonderful interior and exterior decors create goosebumps among the people who make everything possible, be it using the savings or sacrificing their other desires, to bring home a car.

The year 2018, like the preceding calendars, is packed with several new launches which are likely to grab the eyeball of the millions in India. These include the advanced versions of the top-selling models such as Maruti Swift, Hyundai Creta, Datsun Redi GO, among others.

A large chunk of the population is likely to apply for a car loan with a hope that it will get cleared by the lenders. Sadly, many cases get rejected due to a poor CIBIL Score resulting from a plethora of bad credit habits. However, you can Check Your CIBIL Score to get an idea of the credit record you hold. Let us first get updated on how one can check their CIBIL score before examining other necessary details.

How Can You Check Your CIBIL Score?

You can check your CIBIL score easily by registering details at the credit information provider. Just visit the official website of CIBIL, enter your personal details such as name, PAN Number, Date of Birth (DOB), as well as credit-related details, if you have any. As soon as the registration of the details is done, you would need to create a login by choosing a User ID and password.

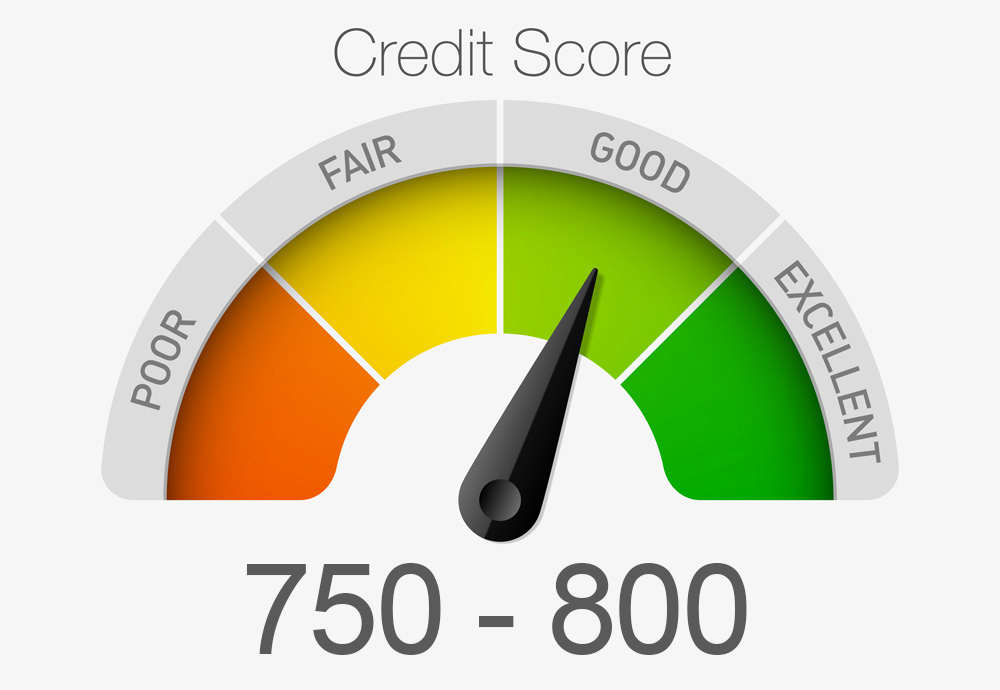

Ideal CIBIL Score for a Car Loan

Lenders seek a CIBIL Score of 750 and above to approve a car loan application.

Why Does CIBIL Score Go Down?

CIBIL Score comes down due to the following reasons.

Constant Late Payment – One of the biggest reasons for a poor credit score is the habit of paying any loan EMI or card bill late and that too, on a regular basis. The continuous late payments bring down the score considerably. The late payment could be a result of the overspending that most do and face the repercussions afterward. You need to be a good judge of the monthly spends you can bear so as to repay the loan or card payment smoothly. The general advice would thus be to prepare a budget and stick to it month-on-month, year-on-year.

Loan or Card Default – Next comes the default in paying the loan EMI or credit card dues. People who are stuck into such a habit often opt for a debt settlement option later on. As per the settlement agreement, lenders can agree to your call of reducing the overall outstanding amount to a degree you would find it comfortable to repay. The settlement option, though, is a dampener to your overall CIBIL Score, making it tougher for you to pass the eligibility test for a car loan. It creates a negative impression among the lenders regarding your creditworthiness. So, avoid default and don’t get into a situation wherein you need to avail a settlement option.

Too Many Car Loan Applications at the Same Time– Prospective borrowers submit applications by applications across multiple lenders at the same time. What happens then is that many lenders seek a credit report from CIBIL at the same, creating a credit-hungry impression of yours. This further translates into a poor CIBIL score and make your car dream a very distant reality. So the message is loud and clear – refrain from making too many applications.

Expected Price of Cars Lined Up for Release

- New Generation Maruti Swift – ₹7.46 lakh

- Hyundai Creta Facelift – ₹14.55 lakh

- Datsun Redi GO – ₹3.75 Lakh

- Mercedes Benz C Class – ₹10.5 Cr

- BMW X3 – ₹54.90 Lakh

So ensure a disciplined spending to be able to pay off your running loan EMI or card dues smoothly to get your CIBIL score notch up all the time. This will help you buy your favourite car on a loan without having to bother about the last minute headache of application rejection due to a poor score.