Financial Privileges For Lady Property Buyers

Nowadays, with many women aggressively investing in property deals, the government and the developers are dynamically launching initiatives to nurture the emerging trend. Generally, being a woman buyer special concessions with reference to several property dealings are available in India. Due to deficiency of realty knowledge and funding issues, women have maintained a distance from real estate world. But, gradually there is a shift in choices, rather than investing the money on fixed deposits or gold only, women are now taking interest in investing in properties too.

The government is also supporting the change by launching “Narendra Modi’s” ambitious “Housing for All” by 2022 scheme. The project has a special call for the women, particularly those who are from economically weaker section (EWS). According to experts, such initiatives will boost the women to have an asset of prominence like home in their name and diversify the portfolio. Due to tax rebates, subsidized stamp duty rates and other benefits, female homebuyers are encouraged to take the plunge in the property market.

Here are some topmost privileges available for the female property buyers-

- Property Registration:

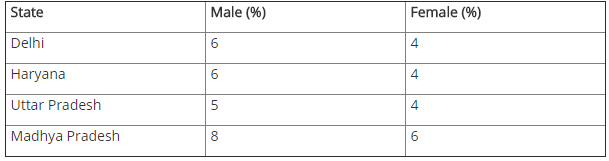

While purchasing a property, registration is the first step, where the buyer pays the stamp duty and registration charges and then the ownership of the property transfers to the new buyer. Property registration prices for man and women are levied and the percentage varies from state to state. In some states, the price of property registration for women is comparatively lower than the male.

*Stamp duty charges in some states

- Tax exemptions & Rebates

There are several lucrative and profitable tax exemptions and rebates for women’s especially. If the property is owned by the lady then, an additional deduction on interest up to Rs 2 lakh can be claimed in every financial year. Apart from this, for leased or rental property, the deductions can be claimed on entire home loan interest against the net rental value. If the both, husband and wife are co-owners and wife is earning separately then, both can claim individual tax deductions depending upon the share of ownership.

- Rewarding Home Loan Interest Rates

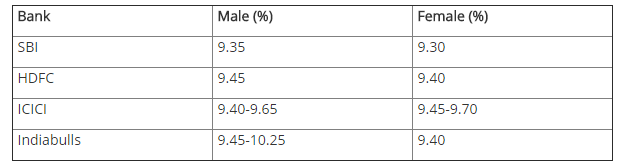

Several governmental, private bank and housing finance companies (HFCs) are proposing home loans at profitable interest rates for women. The interest rates are comparatively lower than what is offered to man buyers. There is an important point to be taken care is that lending banks and house finance company offers discounted interested rates only if the women is the sole or first co-applicant.

*Current interest rates offered by some banks

More Benefits

- Women are permissible to withhold the interest rate paid against the mortgaged loan against the net rental value if the property is for rent.

- It is advised to buy property in joint ownership, it is beneficial as both the spouse can claim for tax deduction for the interest paid on the loan.

After considering all the above mentioned points, experts opine that it is economically a wise decision to get the property registered in the name of women. In case of any property dispute, both the partners will be liable if the property is owned jointly. So it is advised to have a detailed information and know about the pros and cons about the property ownership.