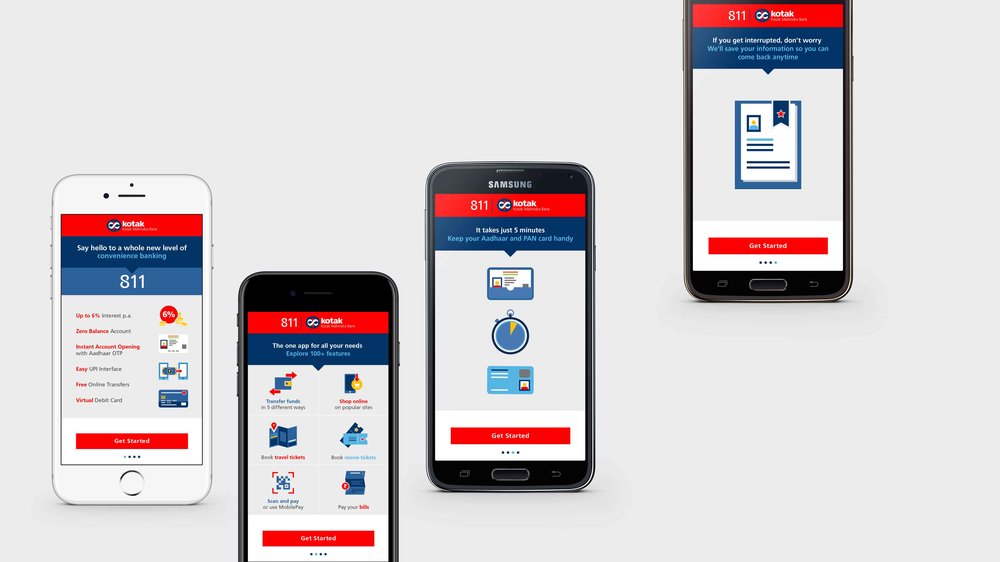

Open Your Savings Account With Kotak 811 App

Kotak Mahindra Bank is the first ever bank to launch account opening facility via mobile App. The name of the app is Kotak 811 wherein you can open an account within few minutes and save yourself from standing in long queues.

The app has other attractive facilities as well which altogether have made it unique. In this article, you will read about the features and benefits of using Kotak 811 App and how can you use it from today itself.

Kotak Mahindra Bank

- 811 Savings Account

- 811 Edge Savings Account

- Edge Savings Account

- Ace Savings Account

- Jifi (Discontinued)

- Platina Savings Account

- Sanman Savings Account

- Junior – The Savings Account for Kids

- Grand – Savings Programme

- Classic Savings Account

- Silk Women’s Savings Account

- My Family Savings Account

- Pro Savings Account

- Nova Savings Account

- Alpha – The Savings & Investment Programme

Key Features of Kotak 811 Account

There are 3 types of Kotak 811 account and the features of each the types are as follows:

811 Savings Account

- India’s First downloadable account

- Zero balance account

- Instant Savings account with Aadhaar Card details

- Earn interest rate up to 6% per annum

- Virtual Debit card facility

- Free IMPS/NEFT using Net Banking and Mobile Banking

- Book movie tickets, flight tickets and shop online with Kotak 811 App

- Pay for instore purchase using Scan & Pay feature

Those who do not have Aadhaar card yet can also enjoy the other two zero balance savings account namely 811 Lite savings account or 811 OTP savings account. The features are as follows:

811 Lite Savings Account

- Transact for up to ₹20,000 per month

- Comes with the validity period of 36 months from the date of savings account activation

- Complete full KYC within 36 months of account activation and upgrade your savings account to 811 Savings Account

- Shop, book movie and flight tickets without downloading other apps

811 OTP Savings Account

- Interest up to 6% per annum

- Zero balance savings account

- Instant savings account opening with Aadhaar Card details

- Online shopping with Virtual debit card

- Pay for instore purchase using Scan & Pay

Features and Benefits of Kotak 811 Plan

Here is the detailed description of Kotak 811 App:

Zero balance account– You can open a zero balance account the app within just PAN card in your hands. You get to earn an interest rate of 5-6% per annum on your savings with the balance over ₹1 lakh and up to ₹5 crores. If you have the balance up to ₹1 lakh, you can earn 5% per annum interest on the amount and in the case of balance above ₹5 crores, you earn 5.50% per annum. There are no penalties for not maintaining the minimum amount.

Scan and Pay– You can pay for groceries, shopping, tickets, movies and other requirements without cash by just scanning your debit or credit card. You can scan the barcode and pay the bill.

Multi-purpose App- Through this App, you can book movie tickets, flight tickets, shop, subscribe to magazines etc.

Virtual Debit Card Accessibility- The introduction of 811 Virtual Debit Card replaces the plastic made the debit card as it is convenient, safe and can be accessed from anywhere at anytime. You just need to carry your mobile phone with yourself whenever you are paying bills or doing recharge or any other online payments in just a few minutes.

Get Loans and Make Investments- Along with other benefits, you can also apply for a loan from this app and not only this you can also make investments. What else can a person want in this busy world?

Eligibility Required to open Kotak 811 Account

The eligibility criteria required by Kotak Mahindra Bank for Kotak 811 Account is as follows:

- Any individual of age 18 years and above can open this account

- The applicant must be a Resident Indian

How to Use Kotak 811 App?

You can enjoy all the services and products just like a regular savings account. You can follow the below steps:

Download App– You can easily download Kotak 811 app from Google play store and start using it instantly.

Provide Aadhar Number- You need to mention your Aadhar Number as it is required for the registration.

Submit the OTP pin- You need to mention the OTP pin that you get on your registered mobile number for authentication to open the savings account on your mobile.

Kotak 811 Customer Care

If you have been facing any issues while using the app, you can contact the bank on 1860-266-2666.